The Australian property market is projected to continue its significant price growth trend into 2025, driven by a potent combination of factors including potential interest rate cuts, persistent supply shortages, and sustained strong demand. Recent analyses from leading institutions such as KPMG and Domain provide in-depth insights into the market outlook across Australia’s major cities.

KPMG Optimistic, Domain Highlights Supply Shortages

A recent report from KPMG forecasts solid price growth for both houses and units across most Australian capital cities in 2025. This optimism is largely based on expectations that the Reserve Bank of Australia (RBA) will begin to ease its monetary policy by lowering interest rates. This decrease in borrowing costs is anticipated to boost consumer purchasing power and encourage more activity in the property market.

Echoing KPMG’s sentiment, Domain also highlights the ongoing issue of property supply shortages, particularly in cities like Sydney and Melbourne. The number of new properties entering the market continues to fall short of meeting high levels of demand, creating upward pressure on prices.

Potential Interest Rate Cuts as a Key Catalyst

Following a series of aggressive interest rate hikes to combat inflation, the market now anticipates a loosening of monetary policy by the RBA. Lower interest rates will make home loans more affordable, attracting more first-home buyers and investors back into the market. This has the potential to trigger a significant increase in demand and further drive up prices.

Strong Demand and Population Growth Play a Role

In addition to the anticipated interest rate cuts, property demand in Australia remains robust, supported by ongoing population growth, primarily through immigration. The arrival of new residents creates a need for more housing, adding pressure to an already undersupplied market.

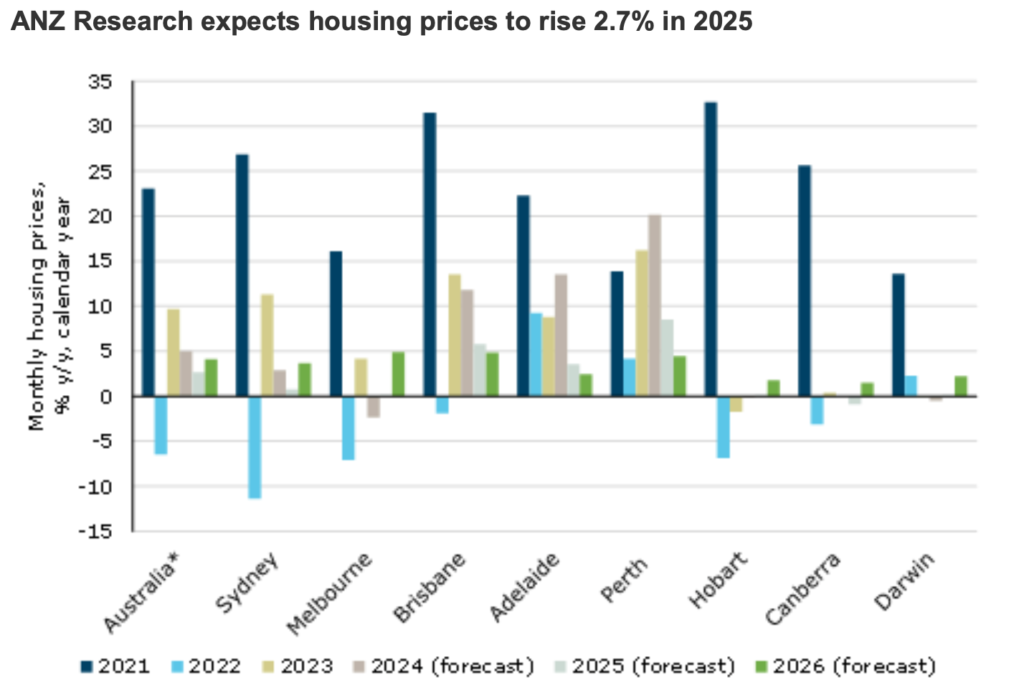

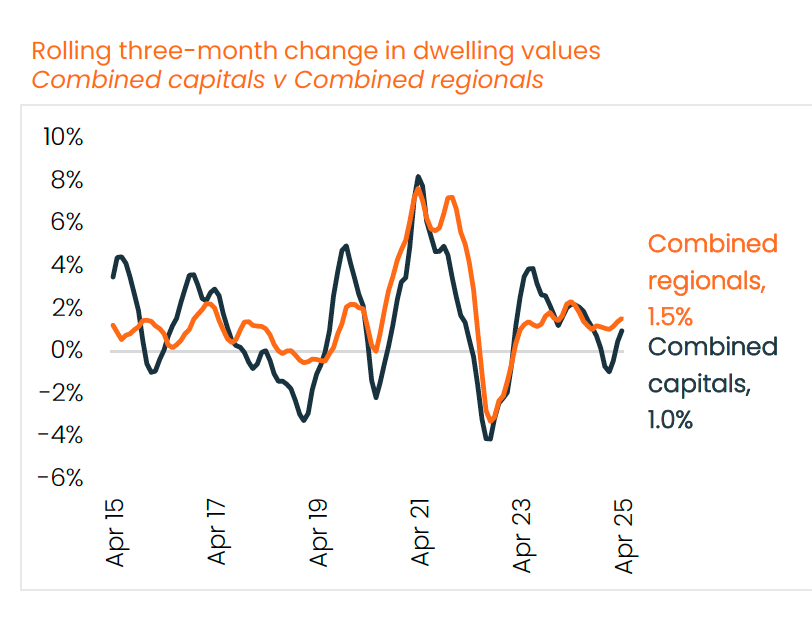

Divergent Growth Across Major Cities

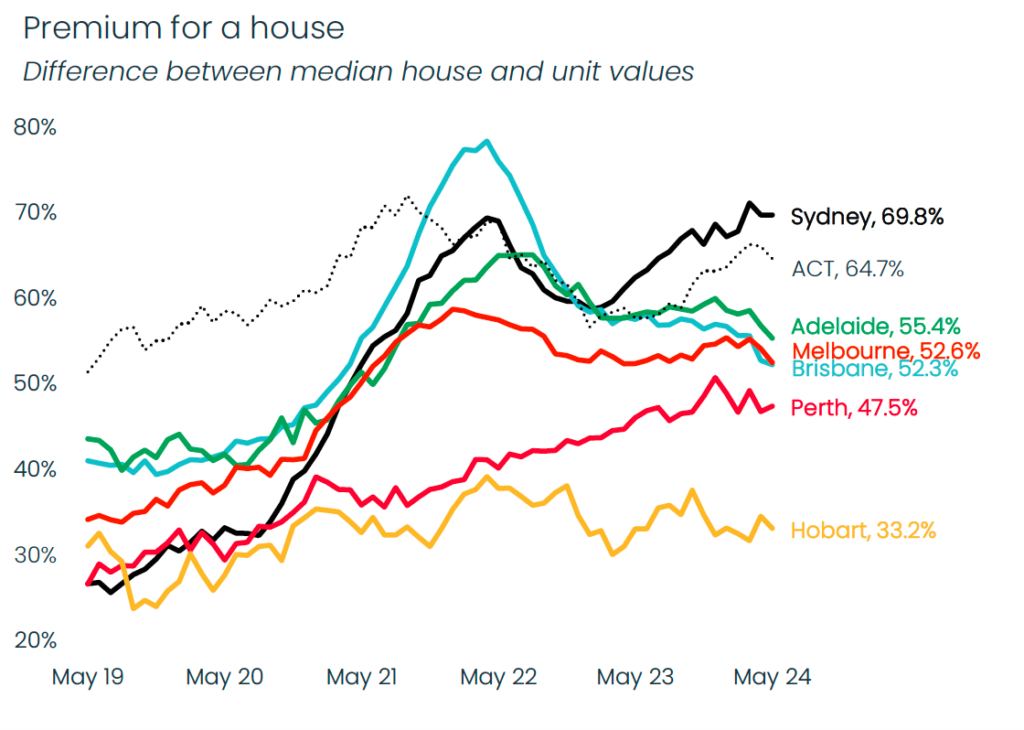

While the overall outlook is positive, reports from KPMG and Domain indicate varying rates of price growth across major cities. Perth and Adelaide are expected to continue experiencing strong growth, driven by resilient local economies and relatively better affordability compared to Sydney and Melbourne. Meanwhile, the markets in Sydney and Melbourne, although predicted to grow, may face greater affordability challenges.

Implications for Buyers and Investors

For prospective homebuyers, these price growth forecasts underscore the importance of entering the market sooner rather than later before prices become even more unaffordable. Meanwhile, property investors may see the potential for significant capital gains, particularly in regions with strong growth prospects. However, it remains crucial to exercise caution and consider factors such as local economic conditions and supply-demand dynamics in each market.

Challenges and Caution Remain Necessary

Despite the seemingly bright outlook for the Australian property market in 2025, challenges such as persistent inflation, potential unexpected interest rate hikes, and affordability issues still warrant attention. Careful analysis of market conditions and advice from property experts are essential for anyone planning to buy or invest in the Australian property market.

Conclusion

With potential interest rate cuts on the horizon, ongoing supply shortages, and strong demand, the Australian property market is projected to experience significant price growth in 2025. While performance may vary across cities, the overall trend indicates a competitive market with the potential for lucrative opportunities for those involved.